MobilPay

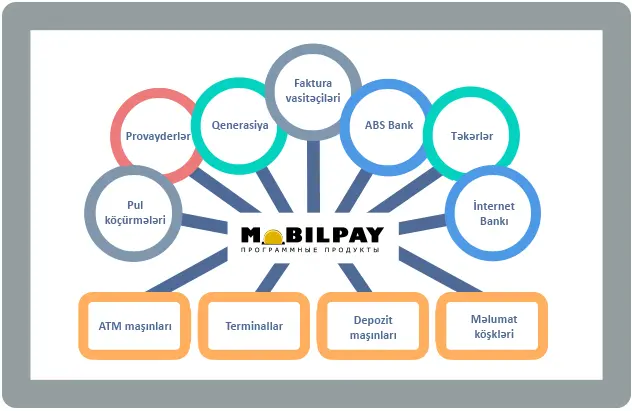

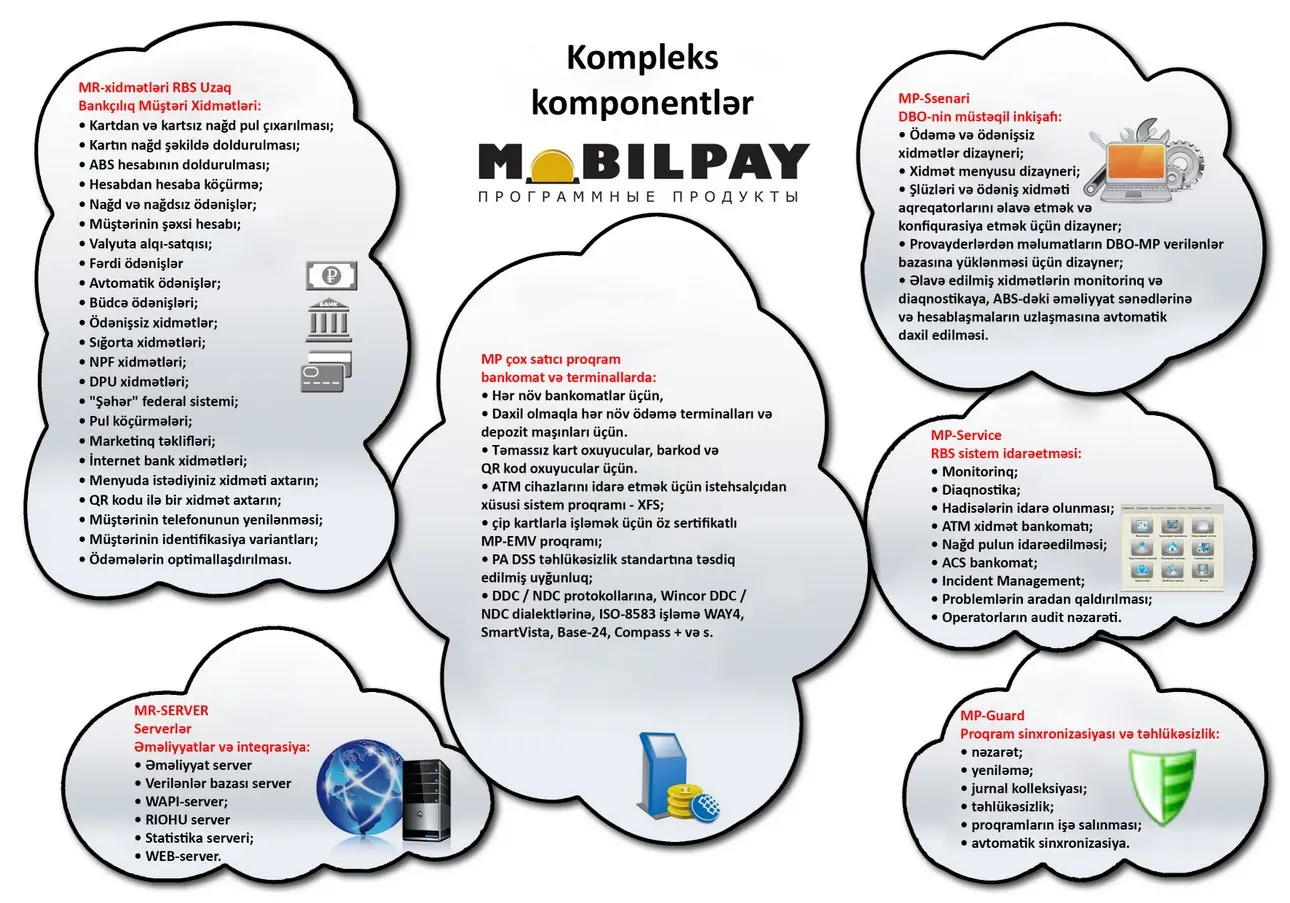

MobilPay is software (software) for remote banking services (RBS) for customers through ATMs and payment terminals. MobilPay software is a set of components on ATMs and payment terminals, on MR servers and workstations of MR operators:

MobilPay software differs significantly from software based on DDC / NDC protocol emulators (for example, TellMe). For the MobilPay software, processing scenarios are fundamentally not needed: operations at ATMs and terminals are controlled by the payment and integration server MobilPay, which took over the functions not only of managing ATMs and terminals, but also of the overall integration of the bank's complex RB System, including Processing, ABS , Internet banking, external billing systems of service providers and service payment intermediaries.

In this complex RBS system between the Processing and the MobilPay server, there is a clear division of "functional responsibilities" based on the original purpose of the processors for carrying out financial interbank transactions through the international payment systems VISA, MasterCard.

Processing ensures the execution of card transactions (cash withdrawal, account replenishment, balance and statement provision, as well as a number of non-cash transactions to the extent of the "advanced" processing), managing ATMs and payment terminals using standard DDC or NDC protocols in accordance with written "state" scripts. This "historical" technology and standards are fully adhered to by MobilPay software (including all aspects of card transactions security). At the same time, the MobilPay-Terminal software component installed on ATMs and payment terminals interacts with Processing using DDC / NDC protocols without the need for any scripts.

In addition to the Processing, the MobilPay payment and integration server is installed in the RBS system, which ensures the execution of cash transactions (cash payments, replenishment of ABS accounts, repayment of loans, etc.) and maintaining a common database on all operations performed through ATMs and terminals, which allows the bank to receive summary reports on all transactions. The MobilPay server interacts with various billing systems of service providers and service payment intermediaries (such as Eleksnet, Cyberplat, Rapida, FSGorod and many others). In addition, the MobilPay server allows interaction with many local, local service providers that do not have on-line billing systems. In this sense, the MobilPay server is a "gateway" for working with various service providers to pay for their services (in particular, providing the client with his personalized data for payment).

The MobilPay server and processing interact with each other according to the ISO-8385, Financial Transactions, Host Gateway (Host-to-Host) protocols, as well as through queries to the database, which allows the bank to implement, at the request of the bank, various schemes for performing financial transactions with the client's accounts. Including the option with filling the processing database with the results of all executed cash and non-cash (card) transactions. Although it is preferable to work with the MobilPay database, since it also provides many means of self-expansion of RBS services by the bank's specialists, operational monitoring, situation diagnosis and management of RBS system operation, statistical reports (including reports on the actual availability of services or their unavailability for specific reasons).

MobilPay-Terminal software is multi-vendor not only in the sense of installing it on various types of terminal equipment, but also providing a unified technology for monitoring and managing the operation of the system, allowing the bank to operate and develop a terminal network using equipment from different manufacturers, connect various payment service aggregators in a single menu bank services, etc. with automatic integration of new system elements into all bank procedures.

MobilPay software provides a huge list of already debugged self-service services for bank customers, including ordinary, widespread services and a number of rather complex personalized client services, services using the reading of payment details from receipts (barcode and two-dimensional QR code), currency exchange and many others.

In addition, the MobilPay-Scenario software provides a unique (real) opportunity for the bank's specialists to expand the list of on-line and off-line payment services of any complexity by themselves, customizing the service menu taking into account the regional specifics and locations of ATMs and terminals, setting various types of fees charged and etc. MobilPay-Trader software also provides the ability for the bank's specialists to add new billing intermediaries for payment for services themselves (such as Eleksnet, Rapida, Cyberplat, etc.). These opportunities for expanding services are extremely important for the continuous development of the RBS business, including using the motivation of specialists from the regional (local) branches of the bank. Moreover, all these possibilities are implemented without any programming and outsourcing resources (!).